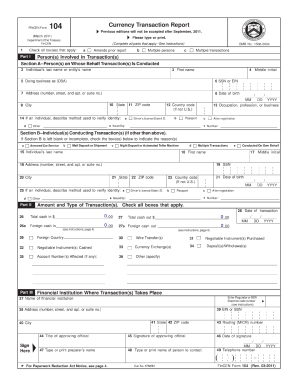

Get the free fincen form 112

Show details

Filing those legacy forms manually might be subjected to civil money penalties. The BSA e-filing system on FinCEN s website now requires electronic filing for all CTRs and requires financial institutions to utilize CTR Form 112 to file these mandated reports. For example Part III page 4 contains information about the forms filed with the exception of multiple locations of aggregation. Using the saved template when filing a CTR can reduce some of the time and resources spent completing the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fincen form 112 pdf

Edit your ctr form 112 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fincen112 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit this form includes several key users through the completion process online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fincen 112 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fincen ctr form pdf

How to fill out ctr form 112:

01

Obtain the form: You can download the ctr form 112 from the official website of the relevant tax authorities or visit their office to collect a hard copy form.

02

Personal Information: Fill out your personal information including your name, address, social security number, and other relevant identification details as required.

03

Income Details: Enter your income details accurately. This may include salary, wages, tips, interest, dividends, rental income, or any other income sources you have.

04

Deductions and Credits: Report any deductions or credits you are eligible for, such as mortgage interest, student loan interest, child tax credit, or any other applicable deductions or credits.

05

Tax Withholding: Provide information about any tax withholdings you have had during the year, such as those from your employer or any estimated tax payments you have made.

06

Sign and Submit: Read the instructions carefully and sign the form where required. Make sure to double-check all the information before submitting it to ensure accuracy.

Who needs ctr form 112:

01

Individuals: Any individual who has an income that needs to be reported to the tax authorities is required to fill out ctr form 112. This includes employees, self-employed individuals, retirees, and those with investment income.

02

Business owners: If you own a business, whether it's a sole proprietorship, partnership, or corporation, you may need to fill out ctr form 112 to report your business income and deductions.

03

Independent contractors: Independent contractors who receive income from various clients or businesses are also required to fill out ctr form 112 to report their earnings and expenses.

04

Investors: Individuals who earn income from investments, such as stocks, bonds, or rental properties, need to report their income and expenses on ctr form 112.

05

Those with other taxable income: If you have any other taxable income that is not covered by the above categories, such as gambling winnings or alimony, you may also need to fill out ctr form 112 to report this income.

In summary, anyone with taxable income, whether it's from employment, self-employment, business ownership, investments, or other sources, may need to fill out ctr form 112 to accurately report their income and deductions to the tax authorities.

Fill

blank ctr form

: Try Risk Free

People Also Ask about form 112

What triggers a currency transaction report?

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).

How do I fill out a CTR form?

0:51 7:38 How to Fill Out a Crew Time Report (CTR) - YouTube YouTube Start of suggested clip End of suggested clip Let's start with how a single resource needs to fill out the CTR block. One is the name of theMoreLet's start with how a single resource needs to fill out the CTR block. One is the name of the resource. This can be left blank for a single resource block. Two is the crew number.

What is acceptable ID for CTR?

Acceptable forms of identification include a driver's license, military or military dependent identification card, passport, alien registration card, state issued identification card, cedular card (foreign), or a combination of other unexpired documents that contain an individual's name and address and preferably a

When should a currency transaction report be filed?

The SAR must be filed by the bank with the Financial Crimes Enforcement Network. The Financial Crimes Enforcement Network – a division of the United States Treasury – is charged with investigating these transactions. This report must be filed within 30 days of the suspicious transaction in most cases.

How do you complete a CTR?

0:51 7:38 How to Fill Out a Crew Time Report (CTR) - YouTube YouTube Start of suggested clip End of suggested clip Let's start with how a single resource needs to fill out the CTR block. One is the name of theMoreLet's start with how a single resource needs to fill out the CTR block. One is the name of the resource. This can be left blank for a single resource block. Two is the crew number.

Can you file a CTR without a Social Security number?

In order to prevent financial crimes, CTRs require institutions to verify the identity and Social Security Numbers of anyone attempting a large transaction, whether or not that person has an account with the institution.

What identification is required for CTR?

Acceptable forms of identification include a driver's license, military or military dependent identification card, passport, alien registration card, state issued identification card, cedular card (foreign), or a combination of other unexpired documents that contain an individual's name and address and preferably a

What are FinCEN requirements?

Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities.

How many days to file CTR requirements?

FinCEN regulations have consistently maintained a regulatory requirement that CTRs be filed within 15 days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ctr form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fincen ctr form 112 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the fincen ctr form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your fincen form 105 sample.

How do I edit fincen 112 form on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form 112 fill online printable bsa forms on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is CTR Form 112?

CTR Form 112 is a report used to disclose currency transactions that exceed a certain threshold, typically required by financial institutions in compliance with anti-money laundering laws.

Who is required to file CTR Form 112?

Financial institutions, including banks and credit unions, are required to file CTR Form 112 for transactions involving cash that exceed the specified threshold amount.

How to fill out CTR Form 112?

To fill out CTR Form 112, the filer needs to provide information such as the date of the transaction, amount of cash involved, the identity of the individuals conducting the transaction, and details about the financial institution.

What is the purpose of CTR Form 112?

The purpose of CTR Form 112 is to help prevent money laundering and other financial crimes by tracking large cash transactions.

What information must be reported on CTR Form 112?

Information that must be reported includes the date of the transaction, the amount of cash transacted, the identities of the parties involved, and the details of the financial institution processing the transaction.

Fill out your fincen form 112 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Currency Transaction Report Form is not the form you're looking for?Search for another form here.

Keywords relevant to ctr form number

Related to fincen form 105 example

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.